In recent years it has been proposed that cutting the farm subsidy program would substantially relieve government debt. Claiming that farmers and ranchers are receiving more than their fair share of government aid, many people view government subsidies as no different than a welfare program for farmers. This is not the case. So, what is the difference between farm subsidies and government welfare?

Before we start, I want to clear up one major issue. In my research for this post, I came across the idea that the US government spends more on agriculture than any other area of its budget. This is not true. As you can see on this chart,

farm subsidies would fall under “other spending”, but they make up such a small portion of the budget that they are not even given their own category. The US budget allocates 1.03 trillion dollars for federal welfare while only 16 billion on government farm subsidies. The US government spends 16 billion on airline subsidies, 20 billion on oil subsidies, and 79 billion on education. So, as you can see, cutting farm subsidies from government spending would not fix our spending overload.

The biggest difference between government subsidies and a welfare program is that to receive a government subsidy, a farmer has to have put in the work to grow the crop and attempt to make a profit. The farmer must plant the crops, putting monetary input into the fuel, fertilizer, machinery, and labor that it takes to grow crops. A farmer must then irrigate (if necessary), pray for rain, and hope that this crop produces grain to harvest and sell for enough money to start all over the next year. In a welfare program, you just must prove that you don’t have the money and you can’t make the money. I realize there are many hardworking people that need government assistance to make ends meet. I’m not bashing that, but I am saying that people on welfare are insured government assistance without doing labor. A farm subsidy program only subsidizes for the crop that had 100% of the labor necessary to produce a successful crop. Farmers do not receive subsidies for crops that were never planted. They also do not receive a subsidy for a crop that was successful unless there is a tariff placed on that certain commodity that won’t allow farmers to sell their product for a fair market price. The only other reason to receive a farm subsidy payment is if there was a large-scale natural disaster that diminished production enough to bankrupt large numbers of farms if they do not receive assistance.

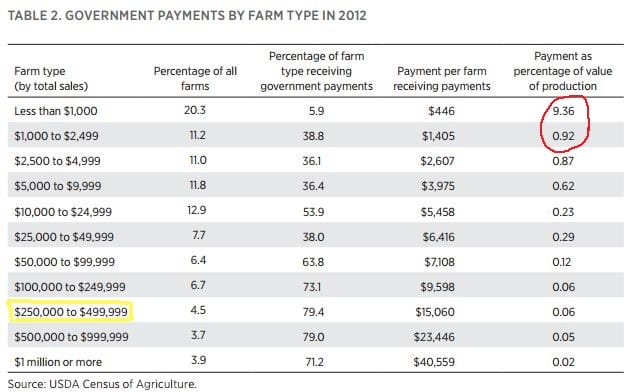

Another major concern for many people is the idea that only large farms receive government subsidies, leaving small family farms to face unsubsidized crop production. This however may be a little misleading. Take a look at this graph which shows the classifications of a small family farm.

Before I looked at it, I assumed that my family’s farm would be considered small. However, over the last five years our average income has placed us just inside the large farm range. It is important to note that basically anything smaller than my family’s farm is not self-sustaining. Not a person’s sole source of income, these farms are “side-jobs” that are supplemented by either one or two people working a town job. A small family farm (sometimes called a hobby farm) can include just a few acres of hay or crops or even a large garden that they use for growing produce to sell at farmers markets. The people planting these farms realize that these are supplemental income sources and not their primary source of production; however, subsidies can equate to 9.36% of their income. These farms are also not equipped to utilize the land as effectively as farmers with larger operations; therefore, it is the farmers with the larger operations that will be the hardest hit if a commodity price drops below subsistence levels or a crop fails. Over the last five years, government subsidies have constituted a whopping .06% of my family’s farm/ranch operation’s annual income. Not exactly a major source of income and definitely not making us rich.

Another difference between farm subsidies and the welfare program is the return our government gets. Whereas a welfare program gives its recipient the means to buy food and other necessities, it is not an economic stimulus for the government. On the other hand, farm subsidies prevent farmers from declaring bankruptcy in a bad year. A farm subsidy is basically an insurance net for the government, guaranteeing the government that it’s agricultural producers can maintain current or more productive levels of farming. Due to the instability of farming because of fluctuating markets and nature, it is imperative that the government have a stable source of Ag resources. 4% of US farms provide 66% of needed farm products for the United States. Agriculture constitutes 9.2% of the US’s total exports; placing agriculture in the top five export industries which is pretty amazing considering that only 2% of the US population is involved in production agriculture. There is no figure of what a welfare program can put back into the economy that helps support it. Welfare is not a way for the government to ensure it maintains production levels as there is nothing produced from a welfare program. So, while there is 21.3% of the US population on welfare, receiving over one trillion a year in government aid, there is no return to the US government. No welfare program would even be feasible if not for agriculture producers producing the necessary amounts of food for our country. The subsidies that are produced are not our sole source of income and not enough to keep our farm/ranch operation going. Subsidies only slightly ease the burden of a failed crop or dropped commodity price due to a trade sanction.

To feed you, a farmer must step out in faith and wait for a crop to grow. Yes, the idea of a little government help if your crop fails is encouraging, but no farmer can live off only government subsidies. In times of crisis, the first people to step up and help are always your agricultural producers. We work to feed our world regardless of their income source or the possibility of a lost crop on our end. The farming community’s partnership with our government should come second to our partnership with our creator. A farmer’s true source of security should be found in his reliance on God to meet his needs while he cares for the land and the people God has created.

Job 11:1-6 (NIV)

Invest in Many Ventures

Ship your grain across the sea; after many days you may receive a return. 2 Invest in seven ventures, yes, in eight; you do not know what disaster may come upon the land. 3 If clouds are full of water, they pour rain on the earth. Whether a tree falls to the south or to the north, in the place where it falls, there it will lie.

4 Whoever watches the wind will not plant; whoever looks at the clouds will not reap. 5 As you do not know the path of the wind, or how the body is formed[a] in a mother’s womb, so you cannot understand the work of God, the Maker of all things. 6 Sow your seed in the morning, and at evening let your hands not be idle, for you do not know which will succeed, whether this or that, or whether both will do equally well.

Deuteronomy 8:10

When you have eaten and are satisfied, praise the Lord your God for the good land he has given you.

Written by Alexis Canen

Resources:

Lexington Law. “44 Important Welfare Statistics for 2020.” Lexington Law, 24 Jan. 2020, www.lexingtonlaw.com/blog/finance/welfare-statistics.html.

“US: Farm Support Still Low, Despite Record Food Stamp Payments.” US: Farm Support Still Low, Despite Record Food Stamp Payments | International Centre for Trade and Sustainable Development, 3 Oct. 2012, www.ictsd.org/bridges-news/bridges/news/us-farm-support-still-low-despite-record-food-stamp-payments.

“USDA Announces Details of Support Package for Farmers.” USDA, www.usda.gov/media/press-releases/2019/07/25/usda-announces-details-support-package-farmers.

“What Are the Biggest Total Government Programs?” United States Total Spending Pie Chart for 2020 – Charts, www.usgovernmentspending.com/united_states_total_spending_pie_chart.